limited pay life policy coverage

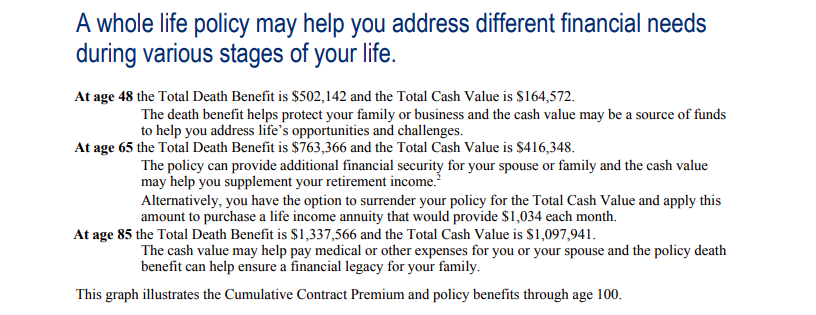

Like other Shelter whole life insurance plans premiums will remain the same during the premium-paying period of the policy. John is a 45-year-old male.

Limited Pay Whole Life Insurance Pros And Cons Youtube

A ten or seven year limited pay policy with a maximum death benefit allowed of 450000.

. A limited pay life insurance policy provides lifelong coverage without a lifelong premium payment. Plans starting at 9mo Plans start at less than 1day Life insurance for less than 250yr. Premiums are usually paid over a period of 10 to 20.

The limited premium payment option allows you to pay premiums only during a certain policy period. A very popular policy currently is a limited pay Index Universal Life or IUL. You may select limited pay life insurance if.

When selecting the limited pay whole life option the payment length must be selected at the time of policy acquisition. This policy has no. With limited pay life you only pay for a set number of years or until you.

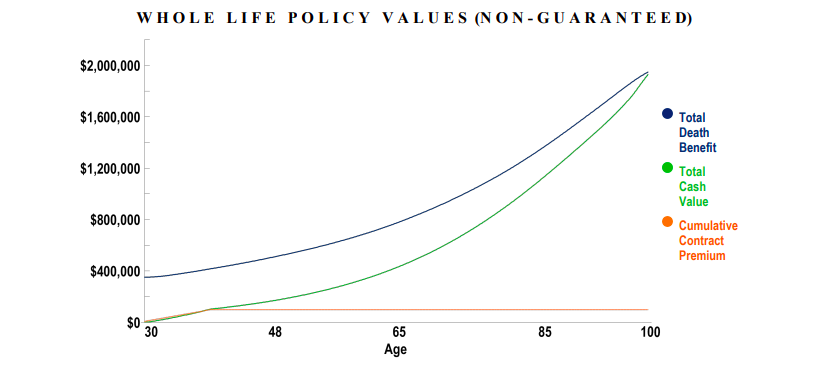

Because limited pay policies have fewer premiums to reach paid-up status they need more significant premiums yearly than continuous pay insurance policies. You get death benefits and lump-sum cash that accumulates during the policy period. If you pay the entire year up front you can usually save some money while.

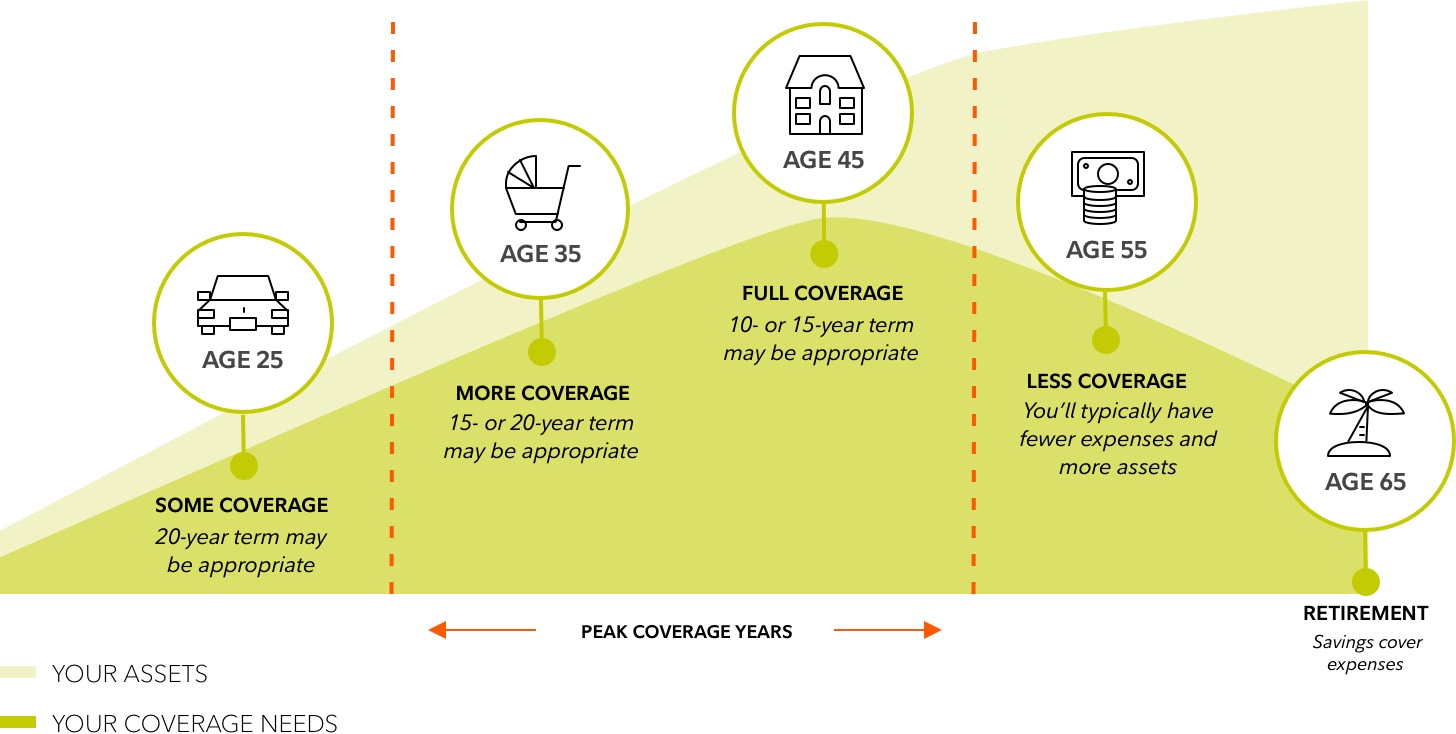

If youre close to retirement age and are shopping for affordable life insurance a limited-pay life policy may be the best fit for you. Life Paid up at 65 is one of the products under the Whole Life insurance series of products which provides coverage for an individuals entire life rather than for a specified period with a limited. For example limited life.

How long does the coverage last on a limited pay life. A limited pay insurance policy is a type of permanent life insurance product sometimes called whole life in which the policyholder pays premiums over a set period of time or until a specific. You can pay the premiums long before the policy expires.

The incremental limited pay life insurance between 10 years and 30 years is able to adjusted or customized depending on WHEN you want to stop. Plans starting at 9mo and less than 1day are based on a 25-year-old female. The same policy would cost a 65-year-old male roughly 37490 per year.

Limited Pay Whole Life Insurance Form 8243 From The Baltimore Life Company. Life Paid up at 65 is one of the products under the Whole Life insurance series of products which provides coverage for an individuals entire life rather than for a specified period with a limited. A limited-pay life policy requires the policyholder to pay premiums for a limited number of years but its coverage last a lifetime.

What is a limited-pay life insurance policy. Premiums on limited payment life insurance are paid for a limited number of years but the benefits last a lifetime. A limited pay whole life insurance policy is not the right choice for every consumer.

7-pay life insurance life paid up to 65 and. Limited payment whole life insurance covers you for life. Limited Policy coverage is a basic type of insurance policy that only pays benefits in the event of certain occurrences or specific events as specified in the contract.

Another component of limited-pay policies is that they offer monthly quarterly or yearly payments. Limited pay life insurance is a type of whole life insurance that allows you to prepay for the entire cost of your coverage for a set number of years. Some people opt for this policy over a 10 pay because the premiums are.

10- or 20- or 25-Pay Whole Life Policies. Premiums are payable for 10 15 or 20 years depending on the policy. A 40-year-old male will pay around 17225 per year on a 10 pay policy with 500000 coverage.

You can purchase a whole life. A 15 pay whole life policy provides coverage that lasts your entire life with premiums due for 15 years.

Limited Pay Life Insurance Whole Vs Term Life

Limited Pay Whole Life Insurance What Is It See The Numbers

Are Limited Pay Life Insurance Policies Ideal

Comprehensive Guide For Buying A Limited Pay Life Policy

Limited Pay Whole Life Insurance Is It Your Best Choice Wealth Nation

What Is Limited Pay Life Insurance Paradigm Life Insurance

Term Life Insurance Financial Resources Coverage Options Fidelity

Learn About Limited Pay Life Insurance 1 866 526 7264

Comprehensive Guide For Buying A Limited Pay Life Policy

What Are Paid Up Additions Pua In Life Insurance

:max_bytes(150000):strip_icc()/Investopedia-terms-termlife-V3-1e8001745dae43aeaa892c04e25d46b1.png)

Term Life Insurance What It Is Different Types Pros And Cons

What Is A Limited Pay Life Policy Clearsurance

If I Can T Pay My Premium What Should I Do Iii

Understanding How Whole Life Insurance Works

How To Reinstate A Life Insurance Policy That You Stopped Paying Forbes Advisor

Comprehensive Guide For Buying A Limited Pay Life Policy

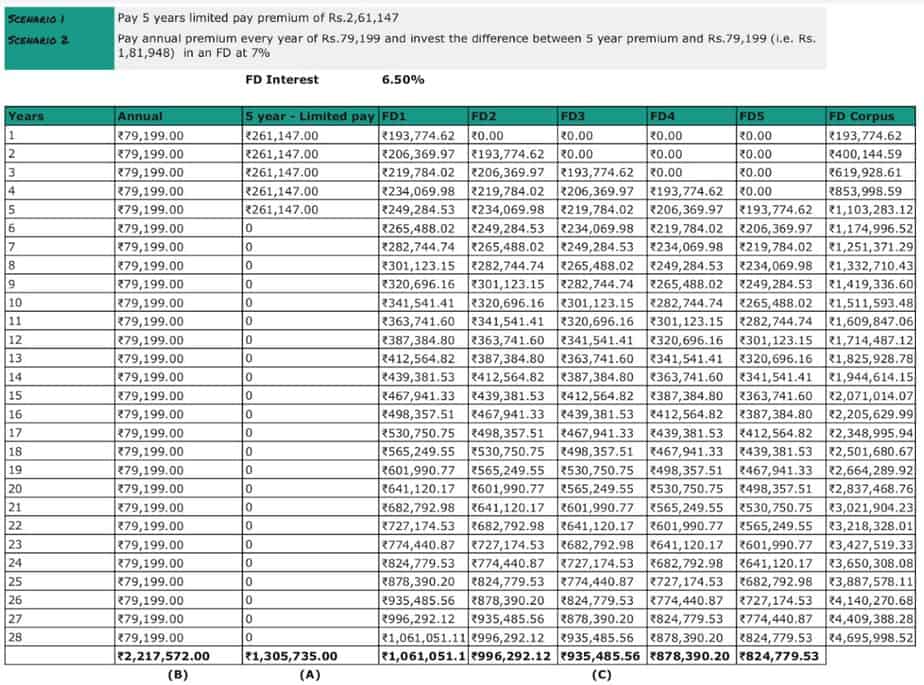

Here Is How Much You Lose In Limited Premium Payment Term Life Insurance

Limited Pay Whole Life Insurance What Is It See The Numbers

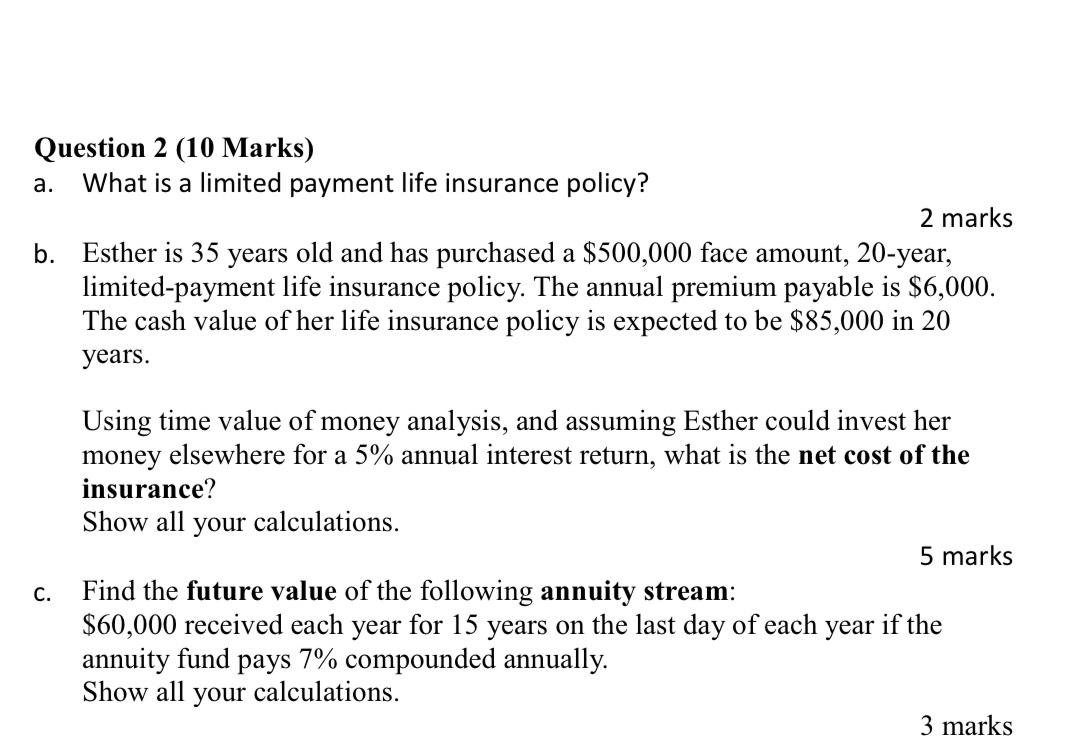

Solved Question 2 10 Marks A What Is A Limited Payment Chegg Com